Technology

Study Reveals Love Scams Are Prevalent in SEA Region

How much is love? Is there really a “price” on love?

As the world celebrates another Valentine’s Day, Kaspersky today explores the risks wrapped in finding relationships online, the possible toll it can incur monetarily, and how users can keep their hearts and finances safe from romance scammers on the internet.

Romance scams are on the rise since 2020 when the pandemic first hit the world. With limited physical movements, the internet, particularly social media platforms, have provided a critical connection for people. Kaspersky’s own research finds that more than half (53%) of social media users around the world have used social networks more during local and national lockdowns than before.

The same research also revealed 18% of the 1,007 adults surveyed to represent Southeast Asia (SEA) use social media mainly to find romance and the majority (76%) confirm that social media has provided them a vital connection during the global health emergency.

In addition, close to a quarter (24%) of the respondents from SEA said that they have formed real-life, in-person friendships with people met initially on social media while another 18% admitted that they dated someone they’ve met on these platforms.

This blossoming way of finding a partner, however, also comes with emotional and financial risks.

For instance, in 2021, law enforcement agencies from Singapore and Malaysia worked together to track down a group specializing in romance scams. The syndicate was allegedly behind at least eight scams in both countries, including the case of a 41-year-old Singaporean woman who ended up losing a total of $28,000.

Another Kaspersky research – “Mapping a secure path for the future of digital payments in APAC” –revealed that almost one in two (45%) in Southeast Asia (SEA) lost money because of love scams online.

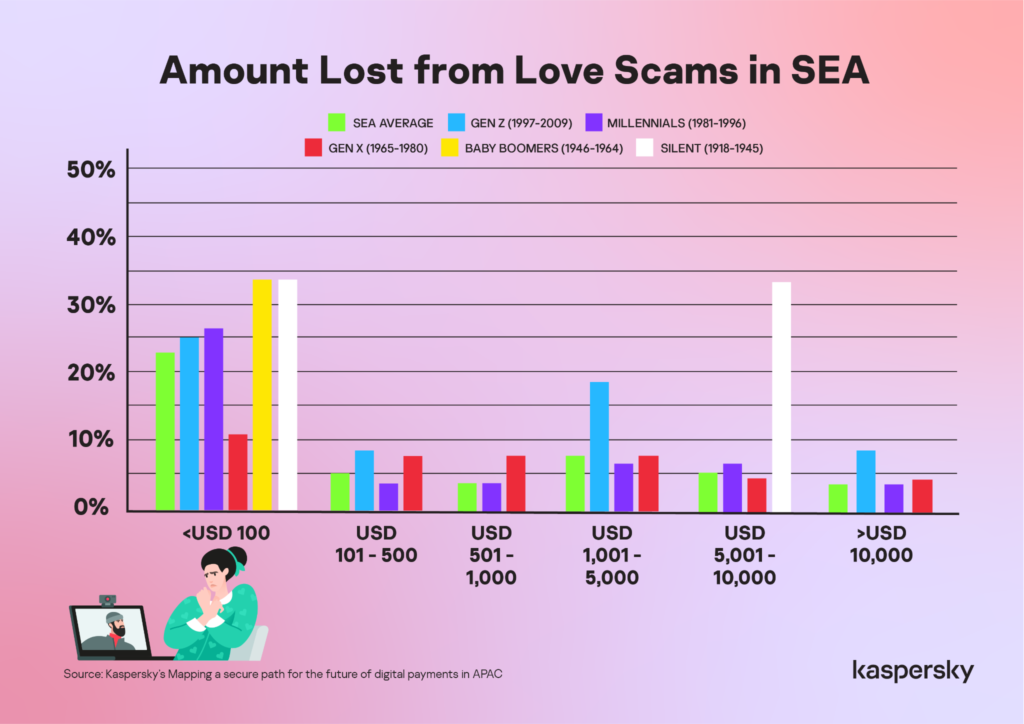

Most of the incidents here only cost less than 100 USD (22%). However, it is worth noting that the victim’s age and the possible cost of a romance scam seem to be overlapping.

With losses amounting to less than 100 USD, the two oldest generations (Baby Boomer and Silent Generation) logged the highest percentage, both at 33%.

The most senior age group, on the other hand, lost the most with nearly two in five of them admitting to losing 5,000-10,000 USD from love scams online.

Lastly, a small portion (8%) of Gen Z said cybercriminals have incurred more than 10,000 USD from romance-related threats.

“When we were younger, we tend to be more curious and a bit more reckless. When we become older, we have a lot of time in our hands and, usually, retirement funds in our bank accounts. Cybercriminals know these realities as well as our human tendencies to be lonely and crave for a company when forced to be alone inside our houses,” says Chris Connell, Managing Director for Asia Pacific at Kaspersky.

“However, the cases we’ve seen lately should serve as a reminder for us to keep our minds “on” even as we listen to our hearts. Because nothing is more painful than having a fake lover and an empty wallet, we urge everyone from all ages to remain vigilant and be better in discerning the authenticity of the relationships we are building online and offline,” he adds.

Regardless of platform or app, warning signs of online dating scams include:

- Demonstration of strong emotions in a very short time.

- A quick move from dating sites or apps into private channels.

- The scammer asks you a lot of questions about yourself. This is because the more they know about you, the easier you will be to manipulate.

- Their story is inconsistent. Scammers sometimes operate in teams, with different people hiding behind one identity. So, if the person you’re talking to seems inconsistent, be suspicious.

- They don’t have a digital footprint. Whilst some people don’t use social media and try to minimize the amount of personal information about them on the internet, it can be suspicious if you can’t find any trace of a person online.

- No video calls or face-to-face meetings. People who are scammed generally report that the other person made constant excuses to avoid going on camera. The obvious reason is that they don’t look like the person in their profile picture. They also want to avoid being identified to prevent being tracked down afterward.

- Requests for money based on personal hardship—for example, for a sick relative or a failed business.

How to avoid online dating scams

- Avoiding romance scams means carefully scrutinizing any online relationship that develops too fast. Here are some more ways to keep your heart and wallet safe:

- When using social media sites, don’t accept friend requests from people you don’t know.

- Avoid revealing too much personal information in a dating profile or to someone you’ve chatted with only online.

- Take things slowly. Ask your potential partner questions and watch out for inconsistencies that might reveal an impostor.

- Use reputable dating sites and keep communicating through their messaging service. Fraudsters will want you to switch to text, social media, or phone quickly, so there is no evidence on the dating site of them asking you for money.

- Never give money to someone unless you also have a relationship with them offline.

- If you do make a date with someone outside of cyberspace, be sure to let people in your life know where you’ll be, to be on the safe side.

To read the full report, please visit https://kas.pr/b6w8.

Survey Methodology

The Kaspersky “Mapping a digitally secure path for the future of payments in APAC” report studies our interactions with online payments. It also examines our attitudes towards them, which hold the key to understanding the factors that will further drive or stem the adoption of this technology. The study was conducted by research agency YouGov in key territories in APAC, including Australia, China, India, Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand, and Vietnam (10 countries). Survey responses were gathered in July 2021 with a total of 1,618 respondents surveyed across the stated countries.

The respondents ranged from 18-65 years of age, all of which are working professionals who are digital payment users.

Through this study, when the behavior of the population of a market is generalized, it is in reference to the group of respondents sampled above.